Mar 4, 2025 |

Imagine: A talented employee casually learns that a colleague in a similar position earns significantly more. What happens? Frustration sets in, trust in the company dwindles, and the thought of quitting becomes obvious. Such scenarios are unfortunately common in companies – a lack of salary transparency leads to injustice, demotivation, and ultimately the loss of valuable talent. [worldatwork.org]

But there are ways to counteract this. Salary bands and the compa ratio provide a strategic framework for making salaries fair and transparent. In this article, we explain the basics, delve into the pain points of a lack of transparency, and present data-driven solutions for fair compensation structures.

1. What are salary bands and compa ratio?

Salary bands are defined salary ranges for specific roles or job levels within a company. A salary band indicates the minimum and maximum compensation provided for a position.

For example, a junior developer might have a salary range of €45,000 to €60,000, while a senior developer could earn between €70,000 and €90,000. This range reflects the value of the role—based on responsibility, required skills, and experience—and is not an arbitrary framework. Rather, salary bands are a central element of a company's compensation strategy and help standardize salary decisions. They ensure that salaries are structured and based on criteria, rather than on the gut feeling of individual managers. In short, salary bands provide a framework for determining what can be paid for a particular position.

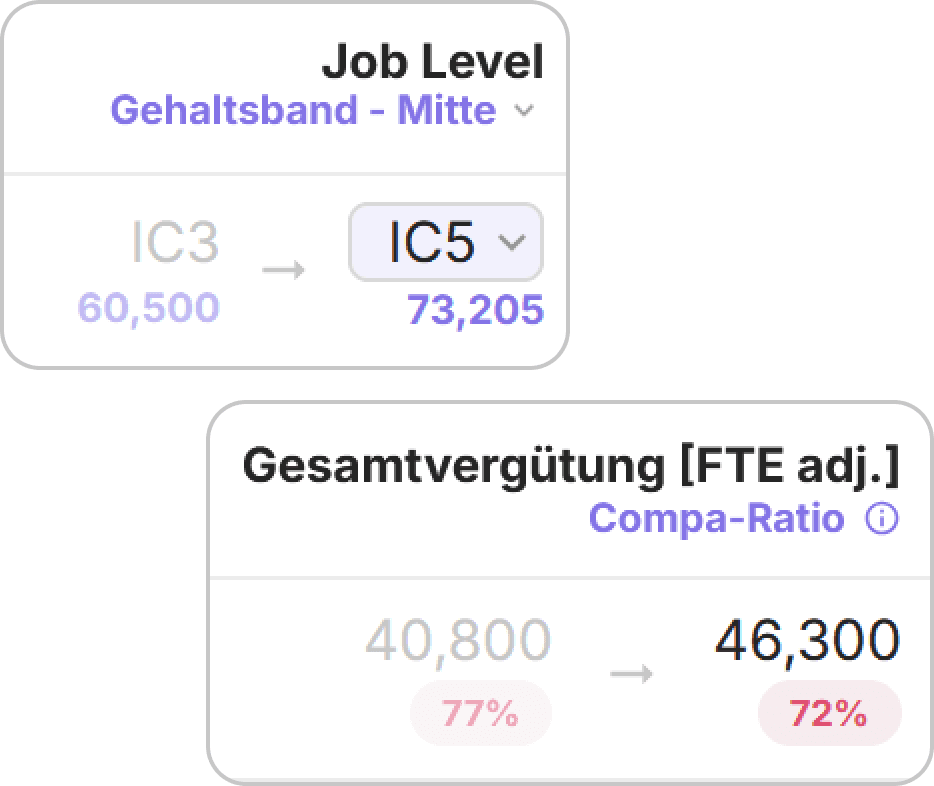

Compa Ratio (Comparative Ratio) is a metric that shows where a person's salary falls within a salary range. More specifically, the Compa Ratio compares an individual's salary with the median, or middle, of the corresponding salary band. The calculation is simple:

Compa Ratio = (Current employee salary ÷ Salary band average) × 100.

A result of 100% means that the salary exactly corresponds to the median – i.e., the person is paid in line with the market or within the target range. If the value is below 100%, the employee earns less than the reference value (e.g., 80% = 20% below the median); above 100% means they are above it (e.g., 120% = 20% above the median).

Important: A value above 100% does not automatically indicate "overpayment," but rather indicates that someone is at the upper end of the intended range – for example, due to long service, outstanding performance, or special skills. The Compa Ratio provides transparency about how competitive and fair a salary is.

Fig.: The diagram schematically shows a salary range with defined minimum, midpoint (median), and maximum. The position of the points illustrates where different employees' salaries fall within this range – and the resulting compa ratio (e.g., employee A at 91%, employee B at 98%, employee C at 114%). Such visualizations help to understand salary distributions within a company.

Why are these concepts so important? Salary bands provide companies with a clear financial framework. HR and managers can use them to plan what new hires should earn and how salary progression should look for promotions. Without defined bands, there is no objective guideline to prevent arbitrary or drastically different salaries.

The compa ratio, in turn, is an indicator of salary equity. It enables comparisons at a glance: Which employees are below target and may be underpaid? Who is above target and may need new responsibilities or a role review? Both tools together promote performance- and market-oriented pay, which can help retain and motivate top talent.

2. The main problem: Lack of transparency and its consequences

Despite the advantages of salary bands and key performance indicators such as the compa ratio, many companies shy away from open salary structures. However, a lack of transparency – that is, salary secrecy and unclear criteria – is a recipe for problems. Employees often perceive the salary distribution as unfair and make comparisons in secret or on platforms such as Glassdoor/Kununu. The emotional consequences within the company are serious: mistrust, declining motivation, and even quiet internal resignation are spreading. Studies show that salary secrecy undermines employees' sense of fairness and leads to more counterproductive behavior.

For companies, this means a concrete risk of increased turnover. Employees who perceive their salary as unfair are more likely to look for a new job. According to a Gartner study, employees who perceive their pay as unfair are 15% less likely to stay and significantly less engaged [figures.hr]. Even more alarming: In a recent survey, 60% of employees said they would change jobs for greater salary transparency [worldatwork.org]. A lack of transparency therefore directly costs talent. High-performing employees – the so-called top performers – are particularly likely to leave if they feel they are paid more fairly and valued elsewhere.

In addition to attrition, a lack of transparency also affects those who stay: frustration and demotivation spread. A lack of internal clarity about how salaries, bonuses, or promotions are determined can erode morale and sow suspicion among colleagues. The team climate suffers, and collaboration becomes more difficult because everyone secretly suspects they are getting a worse deal than others. Ultimately, the company loses twice over – through resignations and through a less engaged workforce.

In summary: Where transparency is lacking, a breeding ground for feelings of injustice develops. Employees ask themselves, "What criteria am I based on when I'm paid?" and "Why does colleague X earn more?" If these questions remain unanswered, negative emotions follow – and good people move on. This is precisely where salary bands and a clear compensation strategy come into play: They create transparency and thus prevent frustration and turnover.

3. Wie definiert man gerechte Salary Bands?

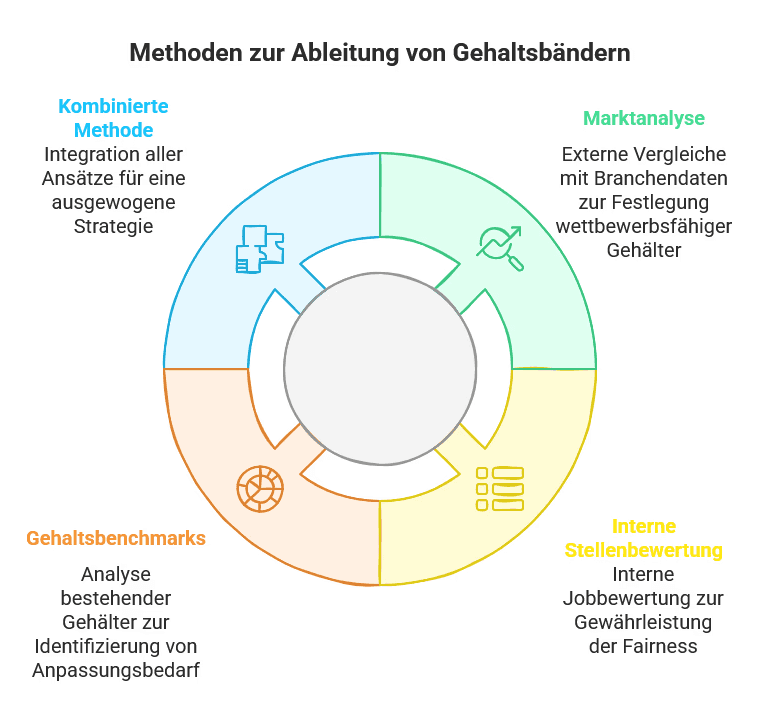

The path to fair salary ranges is strategic work. There are various methods for determining salary bands, depending on company size, industry, and available data. The most common approaches are:

Fig.: Overview of the different ways to derive salary bands.

Market analysis (external comparisons): What do other companies pay for similar roles? This involves using salary data from the labor market—e.g., industry reports, salary studies from consulting firms, or comparison portals. The market rates (median or average salaries) for each position serve as a guide for the middle of the salary range. A company with an ambitious compensation strategy might deliberately pay slightly above the market median to be attractive, while others focus on the median or slightly below. It is crucial to use current and reliable market data, as outdated figures can result in inaccurate ranges.

Internal job evaluation: Every company has its own role value. This method involves evaluating and classifying jobs internally. Procedures such as job grading or point-based evaluation models (e.g., the Hay system) assign a value to each position based on responsibility, skill requirements, impact on company success, etc. This results in job levels or grades. A salary band is then determined for each level. This approach focuses on internal equity: Similar jobs (in terms of value) end up in the same band. This is often combined with market data to ensure that the bands are also externally competitive.

Salary benchmarks & internal comparisons: Here, the existing salary structure is first examined. What ranges are implicitly derived from current salaries? Data from your own employees can be analyzed to identify outliers, either upwards or downwards. Compa ratios of the workforce are a useful tool: You calculate the value for all employees (or groups) and see who falls outside a desired range (e.g., below 80% or above 120%). Based on this analysis, preliminary bands can be formed, which are then compared with external benchmarks. It is also possible to identify critical roles where the company may need to set higher bands to retain talent (e.g., in sought-after tech positions).

Combined method: In practice, all three approaches are usually used in combination. First, a compensation philosophy is defined – for example, do you want to pay market rates, or 10% above market rates, or do you primarily emphasize internal fairness? Job levels and band structures are designed based on this: Each job level is assigned a salary band, which is supported by job evaluation (internal hierarchy) and market value (external data). Factors such as qualifications, experience, and required skills are taken into account. Finally, the bands are compared with the actual salaries of the employees: Where is there a need for adjustment? Where are many employees at the lower or upper end? This creates realistic salary bands that are both in line with the market and are perceived internally as fair.

An example of such an approach: A medium-sized company initially groups its 100 positions into 10 job levels (from entry-level to senior management). Using market salary data, it learns, for example, that Level 5 (specialists) pays between €50,000 and €70,000 across the industry. Internal analysis shows that experienced specialists already earn close to €70,000, while juniors earn around €50,000. The company then sets the salary range for Level 5 at €52,000–€68,000, with a median of €60,000. This range is communicated and used from then on for new hires and salary reviews.

It is important to note that salary bands are not set in stone. They should be reviewed regularly – for example, annually or every two years. The labor market is changing (keywords: skills shortages, inflation, new skills in digitalization), and with them, market salaries are shifting. Employees also develop further. Through monitoring (e.g., the average compa ratio per band), HR can identify early on whether a band might need to be adjusted – either because the company would otherwise lose talent or because the role and requirements profile have changed.

In summary, the clear definition of salary bands provides the company with a clear framework: Everyone knows the salary range for a specific position. This removes arbitrariness from salary decisions and creates trust that things are fair across the company.

4. Practical solutions: Data-driven compensation strategy for more fairness

So, how can a company specifically bring more transparency and fairness to its salaries? The answer lies in a data-driven compensation strategy that actively uses salary bands and metrics such as the compa ratio. The following steps have proven successful in practice:

a) Inventory and data collection: First, all relevant salary data should be compiled – both internally and externally. Internal means: current salaries, job descriptions, performance appraisals, and, if applicable, historical salary trends. External means: industry- and region-specific market data (e.g., salary studies, compensation databases). This database is the foundation for making objective decisions rather than acting on gut feeling.

b) Develop (or update) salary bands: Based on the data, the salary bands are defined – as described in the previous section. Management should work with HR to establish a clear compensation philosophy: For example, do you want to pay top talent above the market? Should performance be rewarded more? Or is cost efficiency the top priority? These guidelines are incorporated into the band definition. Modern HR analytics tools can support this, for example, by enabling simulations ("What would happen if we raised everyone below 80% to 90%?" – what would the cost be?). It is important to document the bands and record them in a comprehensible manner – e.g., in the form of tables, charts, or an internal compensation manual.

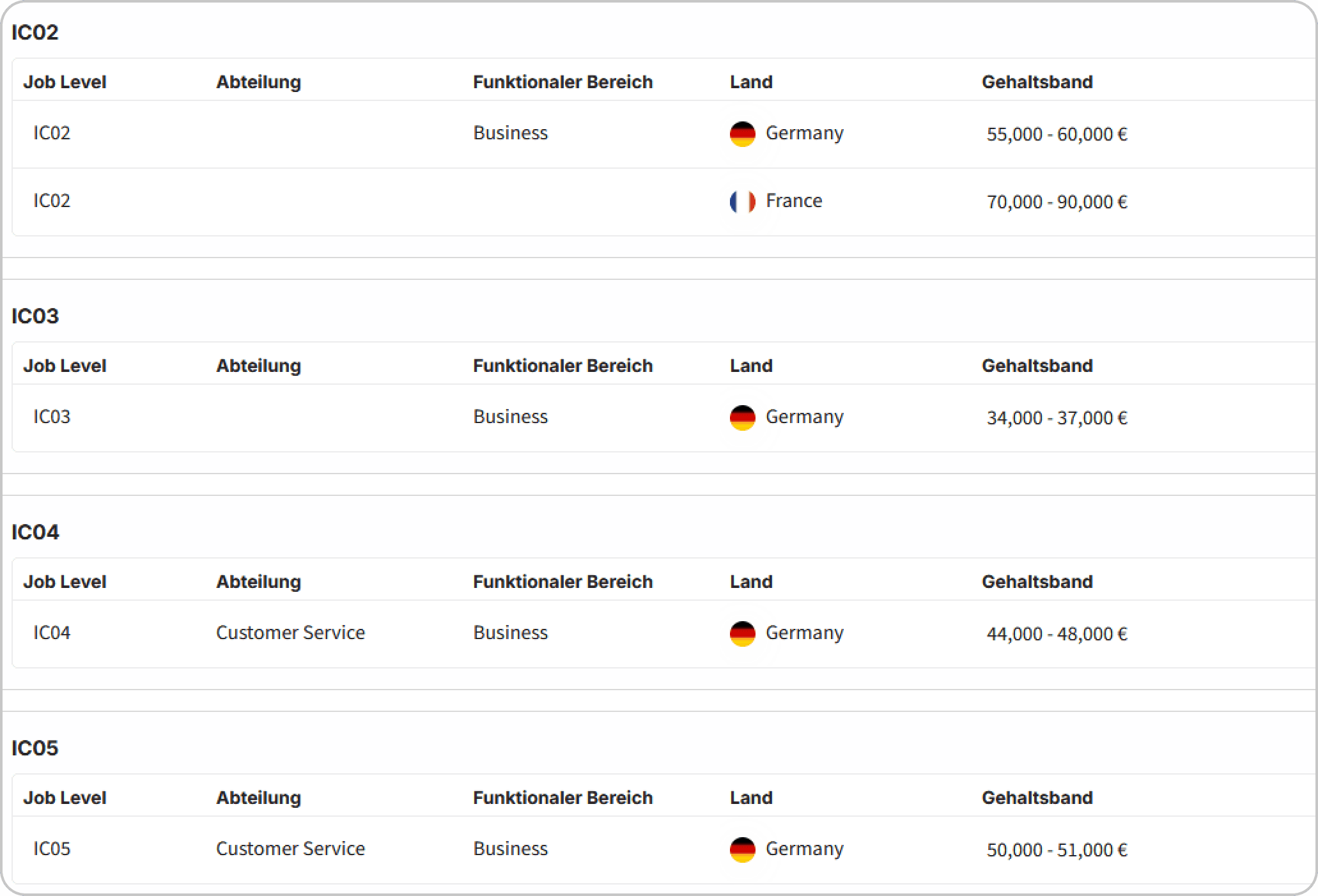

Fig.: Screenshot from Cartha - Salary Bands. Software-supported salary band management simplifies the implementation of salary bands and automates manual work.

c) Calculate compa ratios and conduct internal fairness checks: Using the established salary ranges, each employee can now be classified. The compa ratio is calculated for all employees and compared with the target range (a range of approximately 80% to 120% is often considered acceptable). This quickly reveals outliers: employees who are paid well below the range (risk of underpayment) or significantly above it (risk of overpayment or "legacy" salaries). The company can take targeted countermeasures here. For example, salary increases can be planned for underpaid key employees to at least bring them into the middle range – which should increase their satisfaction and retention. Likewise, cases in which someone is paid well above the range can be questioned: Does the role still correspond to the classification? Is the employee now working at a level that justifies a higher range? This fine-tuning based on compa ratio analyses establishes internal fairness and prevents unconscious pay gaps (e.g. gender pay gaps, if a structured check is carried out to determine whether certain groups have systematically lower compa ratios).

Fig.: Screenshot from Cartha - Compa-Ratios. Processes such as budget planning or salary cycles can promote transparency within the organization through the software-supported use of defined salary ranges.

d) Creating transparency and communication: One of the most important measures – and also the most culturally challenging – is making the salary structures created transparent. Transparency doesn't necessarily mean that everyone knows everyone else's salary (that would be complete transparency). But employees should know: What salary band does my position fall into? What is the general range? How am I classified and why? This information can be disclosed in performance reviews, on the intranet, or in compensation policies. The rationale is crucial: When employees understand why they have a certain salary and what they can do to advance within their band (e.g., advancement to mid- or senior-level positions), acceptance increases enormously. Salary bands are a great help here, as they enable precisely such explanations: "You're currently in the middle of your band because you've been in this role for two years. With more experience and responsibility, you can move towards the upper band." This kind of clear salary language used to be rare, but is increasingly becoming a success factor for companies.

e) Continuous monitoring and adjustment: A data-driven compensation strategy is not a one-time project, but an ongoing process. HR should regularly evaluate key metrics such as average comp ratios, salary range width, percentage of employees at the maximum range, etc. This allows trends to be identified: For example, if many good employees are just below the maximum range, a wave of promotions may be imminent (or the range is too narrow and needs to be expanded). External factors such as the labor market and new legal requirements must also be taken into account. Speaking of laws: In April 2023, the EU Salary Transparency Directive came into force, which will oblige companies to disclose salary information upon request and ensure transparent structures [europa.eu]. Companies that implement a clean, data-driven salary structure early on have a clear advantage here – they not only ensure compliance but also position themselves as a modern, trustworthy employer.

f) Result: Establish a fair pay culture: Implementing the above steps will pay off in multiple ways. A culture of fair pay is created internally, where employees know where they stand. This increases motivation and promotes performance. Turnover decreases measurably – studies show that salary transparency can reduce intentions to leave by around 30% [hrdive.com]. At the same time, the ability to attract talent increases: Companies that state transparent salary ranges in job postings receive significantly more qualified applications and enjoy a trust bonus from candidates. Finally, financial planning also improves: With fixed salary ranges, personnel expenses can be budgeted more precisely, and salary decisions are made within the specified framework, which minimizes surprises (and sudden salary jumps during negotiations).

5. Conclusion: Transparency pays off

The introduction of salary bands and the conscious use of key performance indicators such as the compa ratio may initially seem complex, but the benefits for companies and employees are enormous. A transparent and fair salary structure acts as a strong foundation: It supports a culture of trust, motivation, and commitment. Employees feel valued and treated fairly because they know the rules. Frustration and envy have significantly less room because salaries are based on clear criteria rather than nebulous decisions by the boss.

For HR managers and company leaders, this means fewer difficult salary negotiations behind closed doors and more data-based strategy. Decisions become understandable and justifiable – both for employees and for management, who are keeping an eye on costs. Ultimately, transparency pays off in the truest sense of the word: Companies with fair compensation structures retain their talent longer and attract new ones. Talent churn can be slowed when people are convinced: "My salary here is fair – I know where I stand."

Getting there requires the courage to be open and a systematic approach, but the results speak for themselves. In a working world where skilled workers are hotly contested and fairness is highly valued, no company can afford to keep salaries secret anymore. Salary bands and compa ratio are two powerful tools for shedding light on the situation – and creating a culture in which fair pay is not just a promise, but a lived reality.

In short: Those who invest in the transparency and structure of their salary systems are investing in the satisfaction and future of their team – and thus in the sustainable success of the company. Fairness is not a "nice to have," but a must that can be achieved through smart compensation strategies. Now is the time to shape the change and make salary a topic that unites rather than divides. Employees will thank you – with commitment, loyalty, and a willingness to work together for success.