Jun 27, 2025 |

The year 2025 brings two major developments around severance pay for companies in Germany:

On the one hand, the economic climate is deteriorating, forcing many companies into restructuring. According to a survey by the German Economic Institute, around 40% of companies are planning job cuts for 2025 – particularly in the industrial, tech, and transport sectors.

On the other hand, a new tax rule has been in effect since January 1, 2025: the so-called “fifth rule” (Fünftelregelung) is no longer automatically applied when calculating income tax. Employees must now apply for the tax relief themselves through their tax return.

In short: anyone receiving a severance payment must actively manage their tax optimization – and companies need a clear strategy for planning and communication.

What is severance pay?

Severance payments are one-off payments made by the employer to employees when the employment relationship ends. There is no general legal entitlement to severance – exceptions apply, e.g., in the case of redundancies under §1a of the German Protection Against Dismissal Act (KSchG).

The typical formula:

½ gross monthly salary × years of service

This often serves as a basis for negotiations but is adapted depending on the case – for example, with long tenures or special social criteria.

What does this mean for corporate budgets?

Severance payments have immediate financial implications – especially during larger restructurings.

They count as operating expenses, affect the annual result, and require careful liquidity planning. In difficult times, many companies try to mitigate costs through social plans or voluntary programs with capped payments.

Still, the rule applies:

A structured separation process via severance is often more economical than a lengthy dismissal protection lawsuit.

HR & Finance: Two Perspectives, One Goal

Severance is not just an expense – it's a strategic management tool. That requires close cooperation between HR and Finance – from planning to execution.

HR: Foresight, Empathy, Assurance

Strategic Workforce Planning:

HR proactively analyzes overstaffing, develops alternatives to termination (e.g., internal transfers, upskilling offers), and plans socially responsible exit scenarios.Model Development:

Together with tax and legal experts, HR defines concrete severance models with clear parameters – such as tiered payments or special rules for specific target groups.Transparent Communication:

Especially in sensitive phases, HR takes responsibility for clear communication – with employees, works council, and management.Compliance & Documentation:

Meticulous documentation of all agreements is essential – it maintains standards and minimizes legal risks.

Finance: Planning, Tax Impact, Control

Budget & Liquidity:

Finance models scenarios and incorporates them into mid-term planning. The goal is a balanced view of cash flow, balance sheet, and P&L.Accounting & Taxes:

Severance pay must be recognized at the time of commitment. Since 2025, the automatic application of the “fifth rule” has been removed – tax responsibility now lies with the employee.Risk Management:

Commitments from severance agreements are regularly reviewed – factoring in external influences such as the economy, legislation, and industry trends.

Collaboration as a Success Factor

During restructuring, cross-functional task forces are often formed with HR, Finance, Legal, and Communications.

What makes them effective:

Clear KPIs:

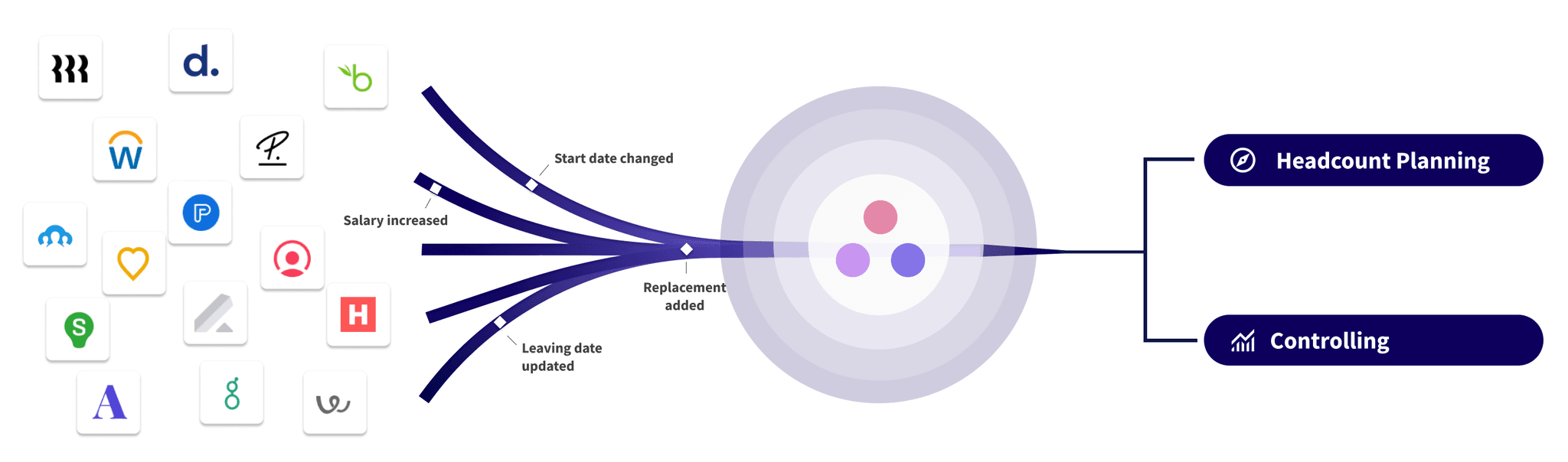

Metrics like average severance cost or budget deviation provide transparency.Shared Data Foundation:

Unified systems enable real-time analytics and sound decision-making.Digital Processes:

Automated workflows accelerate processing and reduce manual errors.

Conclusion: Think Strategically About Severance

Severance pay is more than just a termination fee – it reflects company culture, planning, and care.

Those who realistically calculate the financial impact, communicate clearly, and act with empathy protect both their budget and employer brand.